It has become a prominent and lucrative activity in the digital world. As the popularity of cryptocurrencies continues to soar, understanding the fundamentals of mining has become crucial for anyone interested in this evolving industry. This activity serves as the backbone of decentralized networks, ensuring the integrity of transactions and their security.

What is cryptocurrency mining?

It refers to validating and verifying transactions on a blockchain network. Banks and financial institutions serve as intermediaries to verify transactions in traditional financial systems. However, mining performs this crucial function in the decentralized world of cryptocurrencies.

In what way does it work?

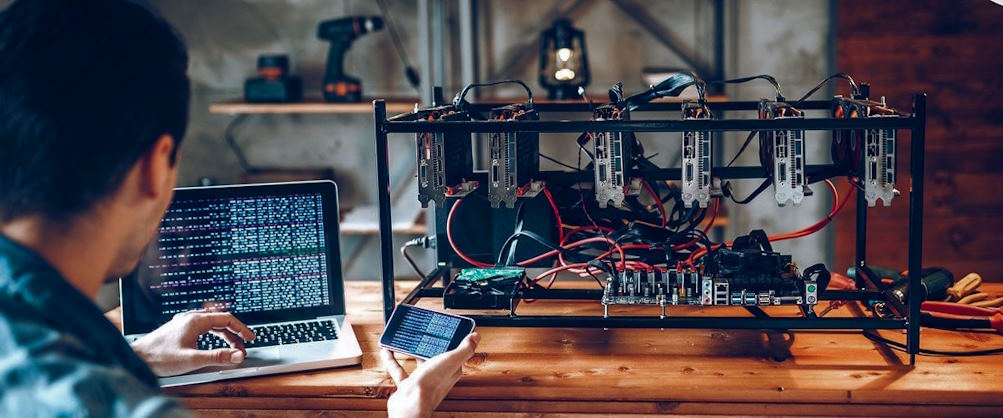

When a cryptocurrency transaction occurs, it must be validated and added to the blockchain, a distributed ledger of all transactions. Miners play a vital role in this process by utilizing computational power and specialized hardware to solve complex mathematical problems. These problems, known as cryptographic puzzles, require significant computational effort.

Miners compete with each other to solve these puzzles, and the first miner to find a valid solution gets to add a new block of transactions to the blockchain. Once a block is added, it becomes a permanent part of the blockchain and cannot be altered or tampered with. This process of adding new blocks to the blockchain ensures the cryptocurrency network’s transparency, security, and immutability.

In addition to validating transactions, miners are also rewarded for their efforts. When miners successfully add a block to the blockchain, they are typically rewarded with newly minted cryptocurrency coins, known as block rewards. These rewards serve as an incentive for miners to participate in the network and contribute their computational power.

It’s important to note that different cryptocurrencies may use different consensus algorithms for mining, the most common being the proof-of-work (PoW) algorithm. PoW requires miners to demonstrate their computational effort and solve mathematical puzzles to secure the network. However, other cryptocurrencies, like Ethereum, are transitioning to the proof-of-stake (PoS) algorithm, where validators are chosen based on the number of coins they hold and are willing to “stake” as collateral.

What are mining challenges and risks?

Mining in the cryptocurrency space presents several challenges and risks that miners should be aware of. These include rising mining difficulty, electricity costs, hardware obsolescence, market volatility, regulatory and legal risks, security vulnerabilities, network congestion, and environmental concerns. Miners must carefully manage these factors to maintain profitability and ensure the sustainability of their operations. Being proactive in staying informed, adapting to market conditions, and implementing robust security measures are crucial in navigating the challenges and mitigating the associated risks of this activity.